Monetary Policy

Monetary Policy

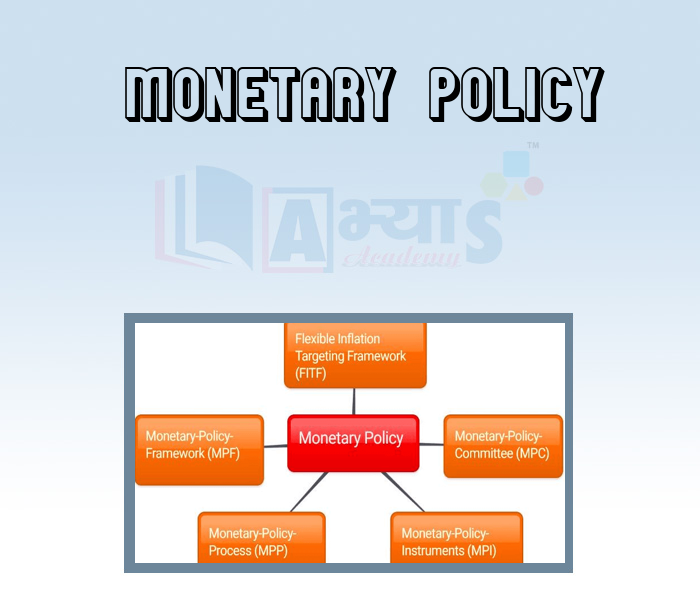

Monetary Policy: Monetary policy is the process by which the monetary authority of a country contrcls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment. Monetary theory provides insight into how to craft optimal monetary policy.

Monetary policy is referred to as either being expansionary, or contractionary, Where an expansionary policy increases the total supply of money in the economy more rapidly than usual, a contracticnary policy expands the money supply more slowly than usual or even shrinks it. Expans:onary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in hopes of avoiding the resulting distortions and deterioration of asset values.

Monetary policy is contrasted with fiscal policy, which refers to taxation, government spending, and associated borrowing. Monetary policy rests on the relationship between the rates of interest in an economy, that is, the price at which money can be borrowed, and the total supply of money. Monetary poliey uses a variety of tools to control one or both of these, to influence outcomes like economic growth inflation, exchange rates with other currencies and unemployment. Where currency is under a monopoly of issuance, or where there is a regulated system of issuing currency through banks which are tied to a central bank, the monetary authority has the ability to alter the money supply and thus influence the interest rate (to achieve policy goals). The beginning of monetary policy as such comes from the late 19th century, where it was used to maintain the gold standard.

There are several monetary policy tools available to achieve these ends: increasing interest rates; reducing the monetary base; and increasing reserve requirements. All have the effect of contracting the money supply, and, if reversed, expand the money supply. Since the 1970s, monetary policy has generally been formed separately from fiscal policy. Even prior to the 1970s, the Bretton Woods system still ensured that most nations would form the two policies separately.

Within almost all modern nations, special institutions (such as the Federal Reserve System in the United States, the Bank of England, the European Central Bank, the People's Bank of China, and the Bank of Japan) exist which have the task of executing the monetary policy and often independently of the executive. In general, these institutions are called central banks and often have other responsibilities such as supervising the smooth operation of the financial system.

The primary tool of monetary policy is open market operations, This entails managing the quantity of money in circulation through the buying and selling of various financial instruments, such as treasary bills, company bonds, or foreign currencies. All of these purchases or sales result in more or less base currency entering or leaving market circulation.

Usually, the shorrt-term goal of open market operations is to achieve a specific short-term interest rate target. In other instances, monetary policy might instead entail the targeting of a specific exchange rate relative to some foreign currency or else relative to gold. For example, in the case of the USA the Federal Reserve targets the federal funds rate, the rate at which member banks lend to one another overnight however, the monetary policy of chine is to target the exchange rate between the Chineese currency and a basket of foreign currencies.

The other primary means of conducting monetary policy inculde:

(i) Discount window lending (lender of last resort)

(ii) Fractional deposit lending (changes in the reserve requirement)

(iii) Moral suasion (cajoling certain market players to achieve outcomes)

(iv) Open mouth operations (talking monetary policy with the market)

Students / Parents Reviews [10]

Abhyas Methodology is very good. It is based on according to student and each child manages accordingly to its properly. Methodology has improved the abilities of students to shine them in future.

Manish Kumar

10thIt was a good experience with Abhyas Academy. I even faced problems in starting but slowly and steadily overcomed. Especially reasoning classes helped me a lot.

Cheshta

10thOne of the best institutes to develope a child interest in studies.Provides SST and English knowledge also unlike other institutes. Teachers are co operative and friendly online tests andPPT develope practical knowledge also.

Aman Kumar Shrivastava

10thIt has a great methodology. Students here can get analysis to their test quickly.We can learn easily through PPTs and the testing methods are good. We know that where we have to practice

Barkha Arora

10thBeing a parent, I saw my daughter improvement in her studies by seeing a good result in all day to day compititive exam TMO, NSO, IEO etc and as well as studies. I have got a fruitful result from my daughter.

Prisha Gupta

8thMy experience with Abhyas is very good. I have learnt many things here like vedic maths and reasoning also. Teachers here first take our doubts and then there are assignments to verify our weak points.

Shivam Rana

7thMy experience was very good with Abhyas academy. I am studying here from 6th class and I am satisfied by its results in my life. I improved a lot here ahead of school syllabus.

Ayan Ghosh

8thI have spent a wonderful time in Abhyas academy. It has made my reasoning more apt, English more stronger and Maths an interesting subject for me. It has given me a habbit of self studying

Yatharthi Sharma

10thIt was good as the experience because as we had come here we had been improved in a such envirnment created here.Extra is taught which is beneficial for future.

Eshan Arora

8thAbhyas is a complete education Institute. Here extreme care is taken by teacher with the help of regular exam. Extra classes also conducted by the institute, if the student is weak.